Introduction: Why ROI Matters

When it comes to real estate investment, the golden question is always the same: “What returns will I get on this property?” This is where ROI (Return on Investment) becomes the backbone of every property decision.

ROI on real estate investment is the most important metric to evaluate before buying any property in Bhubaneswar. Understanding how to calculate it accurately can save you money and maximize returns.

Think of ROI as the measuring tape that tells you whether your property will only look good on paper or actually deliver financial wealth over time. A higher ROI doesn’t just mean better numbers—it means smarter buying, stronger financial security, and the confidence that your investment is working for you.

Table of Contents

Take the case of Rakesh, a young IT professional from Bhubaneswar who was exploring two projects last year:

- Option A: A premium 3BHK luxury apartment in Patia priced at ₹95 Lakhs.

- Option B: A mid-segment 3BHK in Hanspal priced at ₹65 Lakhs.

On the surface, the Hanspal property seemed cheaper and “affordable.” But when Rakesh factored rental income, appreciation trends, and connectivity advantages of Patia, he realized that the Patia flat, though costlier upfront, offered a far better ROI in the long run.

This is why ROI is more than a formula—it is the strategy behind smart property decisions.

The ROI Formula: More Than Just Numbers

At its simplest, ROI is calculated as:

But in real-world property investment, ‘Net Profit’ isn’t just resale price minus purchase price. You need to factor in:

- Loan EMIs & Interest Paid

- Registration Fees & Stamp Duty

- Maintenance Charges

- Property Tax

- Brokerage Fees & Legal Charges

- Vacancy Periods (no rent received)

Step-by-Step ROI Breakdown with Example

Suppose you buy a flat for ₹80 Lakhs. Additional costs:

- Registration & Stamp Duty: ₹6 Lakhs

- Brokerage & Legal: ₹1 Lakh

- Loan EMI (₹55 Lakhs loan @ 8% interest for 20 years): approx ₹45,800/month (₹5.5 Lakhs/year in interest component)

- Maintenance: ₹4,000/month (₹48,000/year)

- Property Tax: ₹10,000/year

Now, you receive a rental income of ₹25,000/month = ₹3 Lakhs/year.

Net Annual Profit = Rental Income – (Maintenance + Property Tax + Loan Interest)

= ₹3,00,000 – ₹6,08,000 = -₹3,08,000 (negative for initial years due to loan interest)

But this is where appreciation and long-term strategy come into play. ROI must always be reviewed over 5–10 years, not just year one.

Case Study 1: Rental ROI in Bhubaneswar (3BHK in Patia)

Property Purchase Price: ₹80 Lakhs (2023)

Additional Costs: ₹6 Lakhs registration + ₹1 Lakh brokerage = ₹87 Lakhs total investment

Rental Income: ₹25,000/month = ₹3 Lakhs/year

Expenses:

- Maintenance = ₹48,000/year

- Property Tax = ₹10,000/year

- Loan Interest Component = ₹5,50,000/year

Net Cash Flow per year = ₹3,00,000 – 6,08,000 = –₹3,08,000

This means ROI from rental alone is negative in early years.

But, if we exclude the loan factor (for buyers who purchase outright):

- Net Income = ₹3,00,000 – ₹58,000 = ₹2,42,000/year

- ROI = (₹2,42,000 ÷ ₹87,00,000) × 100 = 2.78% rental yield per year

Insight: Rental ROI in Bhubaneswar typically ranges between 2–4%, with Patia and Infocity offering the highest yields due to demand from IT professionals and students.

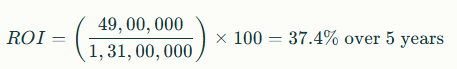

Case Study 2: Appreciation ROI (4BHK in Kalinga Nagar)

Purchase Price (2020): ₹1.2 Crores

Current Value (2025): ₹1.8 Crores

Holding Period: 5 years

Expenses:

- Maintenance = ₹60,000/year × 5 = ₹3 Lakhs

- Transaction Costs (Registration, Brokerage, Legal) = ₹8 Lakhs

Total Investment = ₹1.2 Cr + ₹8 Lakhs + ₹3 Lakhs = ₹1.31 Cr

Net Profit = ₹1.8 Cr – ₹1.31 Cr = ₹49 Lakhs

Now,

Annualized ROI ≈ 7.48% per year

Insight: While rental income was average, the ROI from appreciation in Kalinga Nagar was significant due to new infrastructure, schools, and IT parks boosting demand.

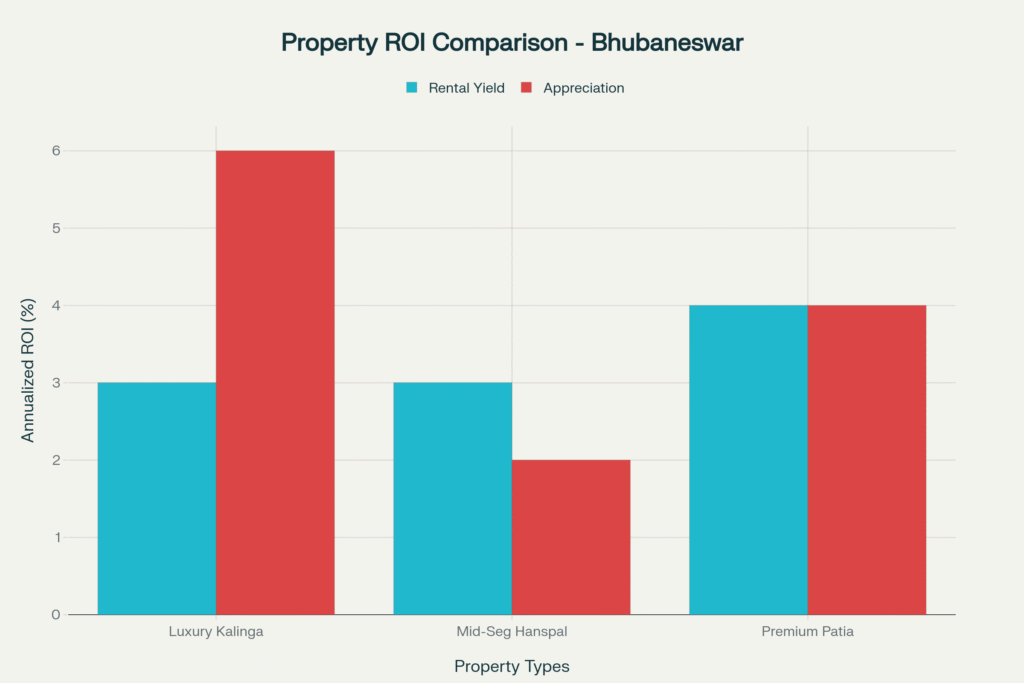

Case Study 3: Comparative ROI

ROI Comparison: Luxury vs Mid-Segment Apartments

| Property Type | Location | Cost | Avg. Rent (per month) | 5-Year Appreciation | ROI % (Rental + Appreciation) |

|---|---|---|---|---|---|

| Luxury 4BHK | Kalinga Nagar | ₹1.2 Cr | ₹35K | 50% | ~8–9% annualized |

| Mid-Segment 3BHK | Hanspal | ₹65 Lakhs | ₹15K | 30% | ~5–6% annualized |

Observation: Luxury assets in prime locations yield higher appreciation, while mid-segment homes provide more stable rental cash flow.

ROI Comparison: Patia vs Hanspal

| Location | Avg. Property Cost (3BHK) | Avg. Rent | 5-Year Avg. Appreciation | ROI % |

|---|---|---|---|---|

| Patia | ₹80–90 Lakhs | ₹25K | 40–50% | 7–8% |

| Hanspal | ₹60–70 Lakhs | ₹15K | 25–30% | 4–5% |

Insight: Location is the single biggest driver of ROI on real estate investment . Patia outperforms Hanspal because of IT, metro, and institutional demand.

Factors That Influence ROI

- Location Growth: IT hubs, smart city zones, metro corridors.

- Property Type: Villas/duplexes in Bhubaneswar mostly rely on appreciation, while 2/3BHK flats earn stronger rentals.

- Builder Reputation: Delays or poor quality reduce ROI.

- Infrastructure Development: Connectivity, highways, hospitals, malls boost values.

- Demand-Supply Balance: Over-supplied micro-markets see weaker rental yields.

Mistakes Investors Make in ROI Calculation

- Ignoring hidden costs like GST, registration, brokerage.

- Overestimating rental demand.

- Forgetting downtime from tenant vacancies.

- Calculating ROI emotionally (“dream home” bias) instead of financially.

Practical Tips to Maximize ROI

- Choose ROI-friendly projects near major employment hubs and schools.

- Invest early at pre-launch stage for lower entry prices.

- Utilize tax benefits under Section 24(b) and 80C.

- Leverage smart bank loans to spread repayment and reduce interest.

- Periodically review ROI every 2–3 years to rebalance your portfolio.

Conclusion

ROI on real estate investment is not just about crunching numbers—it’s about making informed, strategic decisions that balance today’s expenses with tomorrow’s gains. Whether it’s a 3BHK apartment in Patia or a luxury villa in Kalinga Nagar, understanding how to calculate ROI in real estate in India helps investors maximize wealth and minimize risk.

At Saini Properties, with 15+ years of expertise, 30+ builder partnerships, and deep insight into the Bhubaneswar real estate market, we’ve helped hundreds of families and investors find ROI-driven properties that deliver lasting value.

Book your free ROI consultation or schedule a site visit with us today and take the first step toward smarter property investment in Bhubaneswar.

Also refer to other article:

Buying or Renting in Bhubaneswar – What’s Right for You in 2025?