Smart Planning Before Buying a Property in Bhubaneswar

Buying a home is a dream for many, and proper financial planning is the foundation of turning that dream into reality. In a growing city like Bhubaneswar, which is steadily emerging as a real estate hotspot in Eastern India, understanding the budgeting and financing process becomes crucial. Whether you’re a first-time homebuyer or an experienced investor, this guide will walk you through everything from estimating your budget to securing the right home loan.

Table of Contents

Understanding the Bhubaneswar Real Estate Market

Bhubaneswar has transformed into a sought-after destination for property buyers due to its smart city initiatives, improved connectivity, and rapid urban development.

- Popular Localities: Patia, Kalinga Vihar, Chandrasekharpur, and Sundarpada are witnessing significant residential growth.

- Average Property Prices: Range from ₹3,500–₹7,000 per sq.ft., depending on location and amenities.

- Upcoming Developments: Infrastructure projects like the Bhubaneswar Town Planning Scheme, metro rail, and IT hubs are fueling property demand.

Initial Budgeting and Cost Estimation for Property in Bhubaneswar

Before house-hunting, determine how much you can afford.

- Assess Purchasing Power: Use a home loan eligibility calculator to estimate how much a bank might lend based on your income.

- Define Requirements: Flat size, location, amenities, future value.

- Don’t Ignore Hidden Costs: Registration charges (5–7%), stamp duty, GST (if under construction), legal fees, brokerage, and interior furnishing.

Factors Influencing Home Loan Eligibility Property in Bhubaneswar

Home loan eligibility Bhubaneswar depends on several critical factors:

- Income & Job Stability: Salaried individuals with consistent income get preference.

- Credit Score: A CIBIL score above 750 increases chances.

- Age: Younger applicants have a longer tenure advantage.

- Co-applicant: Including a spouse/parent can boost eligibility.

- Property Appraisal: Lenders fund 75–90% of the property’s market value.

How to Improve Your Home Loan Eligibility

- Repay Existing Debts: Clear out personal loans or credit card dues.

- Increase Credit Score: Pay EMIs on time and maintain low credit utilization.

- Apply Jointly: Include earning family members as co-applicants.

- Longer Tenure: Spreads EMIs and increases loan amount eligibility.

Selecting the Right Financing Option

- Banks vs. NBFCs: Banks offer lower interest rates, while NBFCs are more flexible with eligibility

- Compare Offers: Always compare interest rates, processing fees, prepayment charges.

Required Documents for Home Loan Application

Prepare your paperwork in advance for property in Bhubaneswar:

- KYC Documents: Aadhaar, PAN, passport, voter ID.

- Income Proof: Salary slips, ITR, Form 16, bank statements (6 months).

- Property Documents: Sale agreement, NOC from builder, occupancy certificate, title deed.

Step-by-Step Guide to Apply for a Home Loan in Bhubaneswar

- Check Eligibility using online calculators.

- Get Pre-approved: Helps set a budget and fast-track purchase.

- Submit Application to bank/NBFC with documents.

- Verification: Personal, income, and property checks.

- Loan Disbursal: After documentation and legal clearance.

Budgeting Tips for First-Time Homebuyers

- Build a Contingency Fund: For emergencies and maintenance.

- Avoid Lifestyle Inflation: Don’t overspend after loan approval.

- Rent vs. EMI: Ensure your EMI is not more than 35–40% of your monthly income.

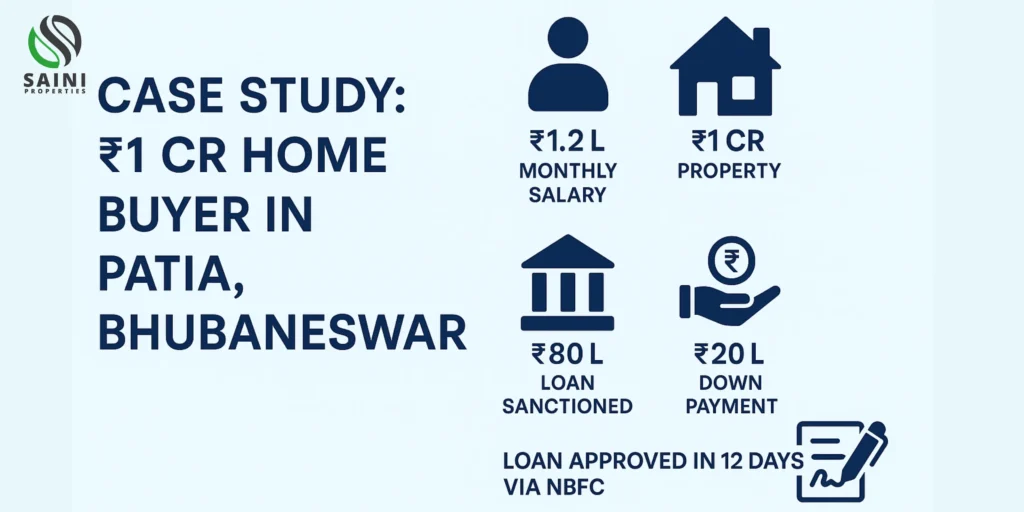

Real-Life Case Study: First-Time Buyer in Patia, Bhubaneswar

- Buyer Profile: ₹1,20,000/month salary

- Location: Patia

- Home Loan Eligibility: ₹75–80 lakhs

- Loan Sanctioned: ₹80 lakhs for a ₹1 crore apartment

- Down Payment: ₹20 lakhs (20% of property value)

- Additional Costs: ₹7–8 lakhs (registration, stamp duty, GST, legal, interiors)

- Financing Journey: The buyer applied through a reputed NBFC known for quick processing and flexible eligibility norms. A pre-approved sanction letter was obtained within 4 working days of submitting all required documents. The entire loan disbursal process was completed within 12 days. To optimize affordability, the buyer chose a 20-year loan tenure and added their spouse as a co-applicant to enhance loan eligibility and share the repayment responsibility.

Tax Benefits on Home Loans in India

- Section 80C: Up to ₹1.5 lakh deduction on principal repayment.

- Section 24(b): ₹2 lakh deduction on interest paid annually.

- Joint Loans: Each borrower can claim individual benefits.

Common Pitfalls to Avoid While Financing a Property

- Neglecting Credit Score: Leads to rejection or higher rates.

- Overborrowing: Don’t rely on future salary hikes.

- Ignoring Fine Print: Understand foreclosure, processing, and late payment terms.

Role of Real Estate Agents and Financial Advisors

- Real Estate Agents: Help shortlist properties, negotiate deals, and verify builder credentials.

- Financial Advisors: Assist with tax planning, choosing the right lender, and optimizing EMI schedules.

Conclusion

Buying a property in Bhubaneswar is both a rewarding investment and a life milestone. With smart budgeting, a clear understanding of home loan eligibility, and the right financial tools, you can make informed decisions that support your long-term goals. Partner with professionals, stay informed, and embrace the journey toward your dream home with confidence.

Visit our detailed guide on: Find Your Perfect Apartment in Bhubaneswar

FAQs

Q1: What is the minimum income required for a home loan for a Property in Bhubaneswar?

A: Typically, ₹25,000/month is the baseline for salaried individuals, depending on other obligations.

Q2: Can NRIs apply for a loan property in Bhubaneswar?

A: Yes, most banks and NBFCs offer special NRI home loan schemes.

Q3: What is the processing time for home loans?

A: Between 7–15 working days, depending on documentation and property evaluation.

Q4: Are there special loans for government employees in Odisha?

A: Yes, many banks offer customized loan packages with reduced interest rates and faster approval.

Q5: Is it better to buy or rent property in Bhubaneswar?

A: Buying is better for long-term wealth creation if you plan to stay 5+ years. Renting offers flexibility for short-term stays.