Buying a home is more than just a financial decision, it is a dream, a milestone, and often a once-in-a-lifetime investment. But the process can also be overwhelming, especially for first-time buyers who are unsure what to look for before signing on the dotted line. That is where a Home Buying Checklist becomes your best companion.

A well-prepared checklist not only protects you from costly mistakes like hidden charges, poor construction quality, or legal disputes, but also gives you clarity and confidence at every step. Think of it as your roadmap that ensures the home you choose today becomes a source of happiness tomorrow, not regret.

In this guide, we will walk you through the top 10 things every buyer must check before buying a house, supported by real-life examples and solutions from families who have gone through the same journey.

1. Verify Legal Clearances

Legal disputes are one of the biggest nightmares for homebuyers. Without proper approvals, your investment may get stuck or even canceled.

Case Study:

A young IT couple booked an apartment in Bhubaneswar’s Patia area at a pre-launch stage. Later, they discovered the project was not RERA-registered, and land disputes delayed construction for 3 years. Their savings and EMIs got locked.

Solution:

Always check for:

- RERA Registration number

- Land ownership documents

- Municipal approvals (BDA, BMC)

- Encumbrance certificate

2. Builder’s Reputation and Track Record

A builder’s history reflects their commitment to quality, on-time delivery, and transparency.

Example:

We once consulted a banker who had invested in a luxury project near Patia. The builder had a history of delays, which the buyer ignored. Result, the handover was 2 years late, forcing him to stay in rented accommodation while paying EMIs.

Solution:

- Check past projects’ completion timelines.

- Visit an already delivered project of the same builder.

- Read reviews from past customers.

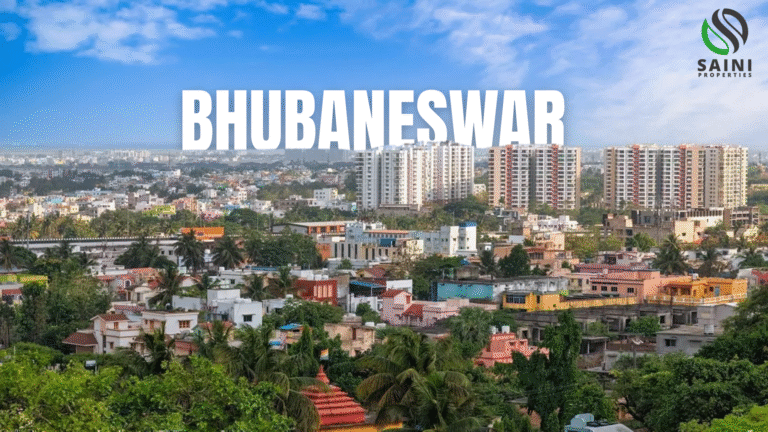

3. Location and Connectivity

A house is not just about interiors, it is about where it stands. Good location ensures both lifestyle comfort and future appreciation.

Case Study:

A government employee purchased a property 12 km away from key schools, offices, and hospitals just because the property looked spacious and affordable. Within 2 years, commuting became a daily struggle and they had to sell at a lower price.

Solution:

- Check distance to schools, hospitals, and markets.

- Assess road connectivity and traffic patterns.

- Evaluate future infrastructure projects nearby.

4. Budget and Financial Planning

Many buyers get emotionally attached and stretch beyond their financial capacity. This often leads to years of stress due to EMI pressure.

Example:

One of our clients booked a 4BHK in Cuttack with high EMIs, ignoring monthly lifestyle expenses. Within a year, the burden became overwhelming, and they had to sell at a loss.

Solution:

- Set a maximum budget before house-hunting.

- Keep EMIs within 30–35% of your monthly income.

- Factor in registration charges, GST, interiors, and maintenance.

5. Quality of Construction

A home is a lifetime investment, poor construction can lead to recurring repairs and safety issues.

Practical Example:

A buyer in Bhubaneswar’s Rasulgarh area ignored checking construction quality. Within 6 months of moving in, walls started developing cracks and seepage.

Solution:

- Check the materials used in previous projects.

- Inspect the sample flat carefully.

- Ask about earthquake resistance, waterproofing, and fire safety measures.

6. Carpet Area vs. Super Built-Up Area

Most buyers only see the brochure area without realizing the difference between carpet area (usable space) and super built-up area (including common spaces).

Example:

A family bought a “1500 sq. ft.” flat but later realized the actual usable carpet area was only 1100 sq. ft. This caused dissatisfaction and disputes.

Solution:

- Always ask for the carpet area (usable space inside walls).

- Compare with other projects before deciding.

7. Hidden Charges and Maintenance Costs

Many buyers get shocked when they face additional charges for parking, club membership, or high maintenance fees.

Case Study:

A first-time homebuyer purchased a property in Patia but was later asked to pay heavy “one-time corpus” and “maintenance advances” that were never disclosed earlier.

Solution:

- Ask for a detailed cost sheet before booking.

- Enquire about monthly maintenance charges.

- Confirm parking, power backup, and club usage charges.

8. Future Resale Value

Your house should not just be a place to live but also a good investment. Ignoring resale value can reduce financial security.

Example:

A doctor invested in a 2BHK far from the main city with limited growth. After 5 years, the resale value barely appreciated compared to city-center projects.

Solution:

- Choose a location with high demand.

- Check upcoming infrastructure like metro, highways, IT parks.

- Properties near schools, hospitals, and offices usually have better resale.

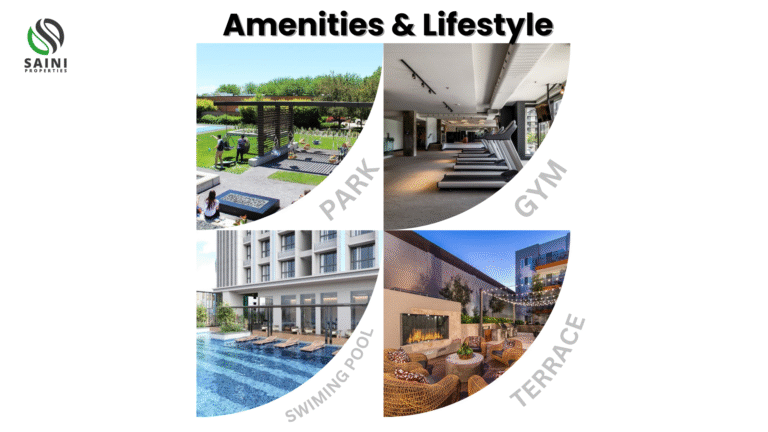

9. Amenities and Lifestyle Needs

Modern buyers prefer projects with security, power backup, play areas, and green spaces. Ignoring these can reduce comfort and future buyer interest.

Case Study:

A retired couple bought a flat in Bhubaneswar outskirts with no lift. Within a year, it became a struggle due to age-related issues, and they regretted not prioritizing amenities.

Solution:

- Check lifts, security, parking, green areas, kids’ play zones.

- Ask about water supply and backup electricity.

10. Professional Guidance

Many buyers try to manage the entire process alone, often missing hidden risks and opportunities.

Example:

A businessman booked a flat directly from a builder without consulting an advisor. Later, he discovered high hidden costs and legal gaps. If he had consulted early, he would have avoided these losses.

Solution:

- Work with a trusted real estate advisor who understands Bhubaneswar’s market.

- Advisors can help with property comparisons, legal checks, and negotiation.

Buying a house is not just a financial decision, it is an emotional journey. Every buyer dreams of a safe, secure, and happy home, but one small mistake can turn this dream into stress.

At Saini Properties, we have guided thousands of families in Bhubaneswar and Cuttack to buy their dream homes without regrets. From checking legal papers to selecting the right builder and location, we stand by you in every step.

Remember: A home is a lifetime investment; make it with the right knowledge and guidance.

- Legal Clearances

- Builder Reputation

- Location & Connectivity

- Budget Planning

- Construction Quality

- Carpet Area vs Super Built-up Area

- Hidden Charges

- Resale Value

- Amenities & Lifestyle Needs

- Professional Guidance

When you book your site visit through Saini Properties, you don’t just get a tour,

you unlock exclusive discounts, early-buyer benefits, and direct coordination with the builder.

We’ll handle everything—from priority site access to price negotiations.

Call Now: +91 – 91245 70571

Or Click here to Book Your Visit

Buyers often ignore legal checks, overstretch budgets, and fail to verify builder credibility. These mistakes can lead to delays, disputes, and financial stress.

Check for RERA registration, land ownership documents, municipal approvals, and encumbrance certificates. Consulting an expert helps avoid risks.

Location impacts your daily lifestyle, commute, and resale value. Properties near schools, hospitals, and business hubs in Bhubaneswar tend to appreciate faster.

A property advisor ensures legal checks, transparent deals, and negotiates better terms, helping you avoid hidden risks.